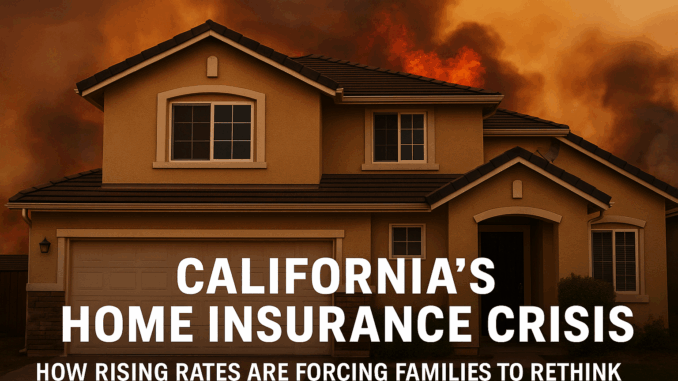

As wildfires, inflation, and insurer pullouts continue to shake the Golden State, California’s home insurance market is nearing a breaking point. Homeowners are now facing skyrocketing premiums, reduced coverage options, and increased policy cancellations—forcing thousands to rethink how they protect their most valuable asset.

🔥 A Perfect Storm of Risk

California’s vulnerability to natural disasters—particularly wildfires—has made the state one of the riskiest markets for property insurers. The number of catastrophic events has climbed over the past decade, leading insurers to either hike rates or exit the market entirely.

In 2024 alone:

Over 85,000 homeowners lost coverage from private insurers.

Many were forced into California’s last-resort FAIR Plan, which offers limited protection at higher costs.

Some regions have seen premiums double or even triple, with no guarantee of policy renewal.

📉 Why Insurers Are Pulling Back

It’s not just wildfires. Insurers cite:

High reinsurance costs (what insurance companies pay to insure themselves),

Regulatory constraints that make it difficult to adjust premiums quickly,

And rising construction costs, making claims far more expensive to fulfill.

This mix of unprofitable underwriting and legal limits on rate hikes has led major players like State Farm and Allstate to halt new home insurance policies in California altogether.

💬 CBS Los Angeles Takes Action

Recognizing the growing urgency, CBS Los Angeles launched a community-driven campaign:

“Home Insurance: We’ve Got You Covered” — a weeklong initiative focused on education, support, and solutions.

Key highlights:

Live Q&A sessions with insurance lawyers and policy experts,

Real homeowner stories and case studies,

A hotline that answered over 500+ calls in 3 hours, showing how widespread the confusion and concern really is.

🏠 What Homeowners Can Do Now

In this challenging market, California residents should act proactively:

Review your policy annually – Understand coverage gaps, especially for wildfire and earthquake.

Consider risk mitigation upgrades – Fireproofing, smart home monitoring, and sprinkler systems may reduce premiums.

Explore alternative providers – Smaller regional carriers and surplus line insurers may offer competitive options.

Know your rights – California law limits how insurers can drop or deny you coverage. File a complaint if you feel unfairly treated.

⚖️ Policy Changes on the Horizon?

State regulators are under immense pressure to balance consumer protection with insurer sustainability. Proposed reforms include:

Allowing more flexible risk-based pricing,

Faster rate adjustment approval processes,

And possible public-private insurance partnerships to share wildfire risk.

🧭 Final Thoughts

California’s home insurance crisis is a warning signal for climate-vulnerable regions everywhere. As premiums rise and coverage shrinks, insurance is no longer a given—it’s a strategy.

For homeowners, staying informed and prepared is the first step toward regaining control in an increasingly uncertain landscape.

Leave a Reply